,%20even%20a%20man%20and%20His%20Heritage%20(Taxes)%20King%20Benjamin.jpg)

%20unto%20God%20the%20things%20that%20are%20God's..jpg)

%20-%20First%20Amendment.jpg)

Government Officials Steal Man's Home Over $8.41 In Unpaid Taxes

when their property was

seized by Wayne County, Michigan, in 2017 and sold to a private buyer… All

because they unknowingly underpaid their tax bill - by $144… While he had paid

his 2012 and 2013 property taxes in full, he discovered that he had

accidentally underpaid in 2011. When he made this realization and tried to

correct his mistake in 2013, he forgot to account for the interest that had

accrued on his back taxes. As a result, he underpaid by a measly $8.41. The

county seized and sold his property for $24,500. Rafaeli never saw a dime of

this money.

https://www.zerohedge.com/news/2019-07-28/government-officials-steal-mans-home-over-841-unpaid-taxes

Are We Really Free?

Maybe It's Time For A Personal Declaration Of Independence

- You never own your home outright, even when the mortgage is paid off. Every year, you must make your extortion payment to the city or trust me, you won’t be living in that house for long.

- The same thing with your car. If you don’t pay your annual extortion payment on your vehicle and pay a hundred bucks for a tiny sticker that gives you permission to drive it, it will be promptly towed away by the city with the government’s blessing. Then, like a hostage negotiation gone wrong, you’ll have to pay even more money to cover their theft and storage of YOUR vehicle.

- On a regular basis, you must pay a fee and ask the government for permission to do any number of things, such as driving a car, traveling outside the country, running a business, adding another bathroom to your home, or even catching a fish for dinner.

- Permits and licenses are big revenue generators from start to finish – and if you proceed without asking permission, they will extort more money from you in the form of fines. If you refuse to pay the fines (or if you can’t) they’ll kidnap you and lock you in a cage, where you’ll be forced to perform manual labor for 10 cents an hour for whatever length of time the legal authorities feel is sufficient to teach you a lesson.

- There are places in our nation where you can’t use your property the way you want. There are areas where you cannot collect the water that falls on your land. There are places where you aren’t allowed to detach your home from the grid. There are places that dictate where your vegetable garden can grow (or even if you’re allowed to have one), places that won’t allow you to hang your clothes out to dry, and places that make it illegal to sleep in your car.

And it goes far beyond

taxation…

Utah Loves the Gospel of Theft !!!

Utah Legislators propose new taxes on food, gas (OVER 90% Utah Legislators are LDS & LOVES THE Gospel of THEFT !!!!)

Utah Legislators propose new taxes on food, gas (OVER 90% Utah Legislators are LDS & LOVES THE Gospel of THEFT !!!!)

KSL - 10-18-2019

Tax Restructuring and

Equalization Task Force meeting Tuesday would restore the full state sales tax on food… A long list of new

services would also be subject to sales taxes,

including those provided by veterinarians, taxi,

limousine, Uber and other ride-sharing drivers,

tour guides, portrait photographers, sports

instructor, fine arts and other types of schools,

tow trucks, wedding planners, parking lots, software, streaming media

and shipping…sales tax exemptions would be

removed, including for some construction materials; electricity used to operate

ski lifts; admission to college sporting events; textbooks, electricity

produced by alternative energy sources; gold, silver and platinum; vending machine

food and fuel…allow the state’s 4.85% sales tax to be

added to the wholesale price of gasoline, on top of the state’s

31-cents-a-gallon gasoline tax. The measure is seen as a stopgap until a

new user fee for drivers, such as charging by miles driven, can be

implemented…The state sales tax on food, reduced years ago to 1.75%, would be

restored to the full 4.85% rate.

https://www.ksl.com/article/46658005/legislators-propose-75m-tax-collection-reduction-but-new-taxes-on-food-gas-proposed

Steve Forbes Open Letter

To Mark Zuckerberg

CALL the NEW

CURRENCY “Mark.” (of the Beast)

you might consider

changing the Libra’s name. The

“Libra” was a measure of weight from the Roman Empire, and we know where that

ended up. Don’t be bashful; call it the “Mark.”

Germany ditched its mark—which it had been using since it created it after

WWII—for the euro 20 years ago, so the name is up for grabs.

A gold-backed

Mark would be a transformative move in the history of money. It would blow bitcoin out of the water and would generate

an enthusiastic “Like” from billions of businesses and people, now and forever.

Sincerely, Steve Forbes

(NO VACCINES? YOU WILL GET IT IN YOUR FOOD)

Toxic heavy metals damaging to your baby's brain development are likely in the baby food you are feeding your infant, according to a new investigation published Thursday.

Tests of 168 baby foods from major manufacturers in the U.S. found 95% contained lead, 73% contained arsenic, 75% contained cadmium and 32% contained mercury. One-fourth of the foods contained all four heavy metals. (God gave woman boobs for babies, more curses)

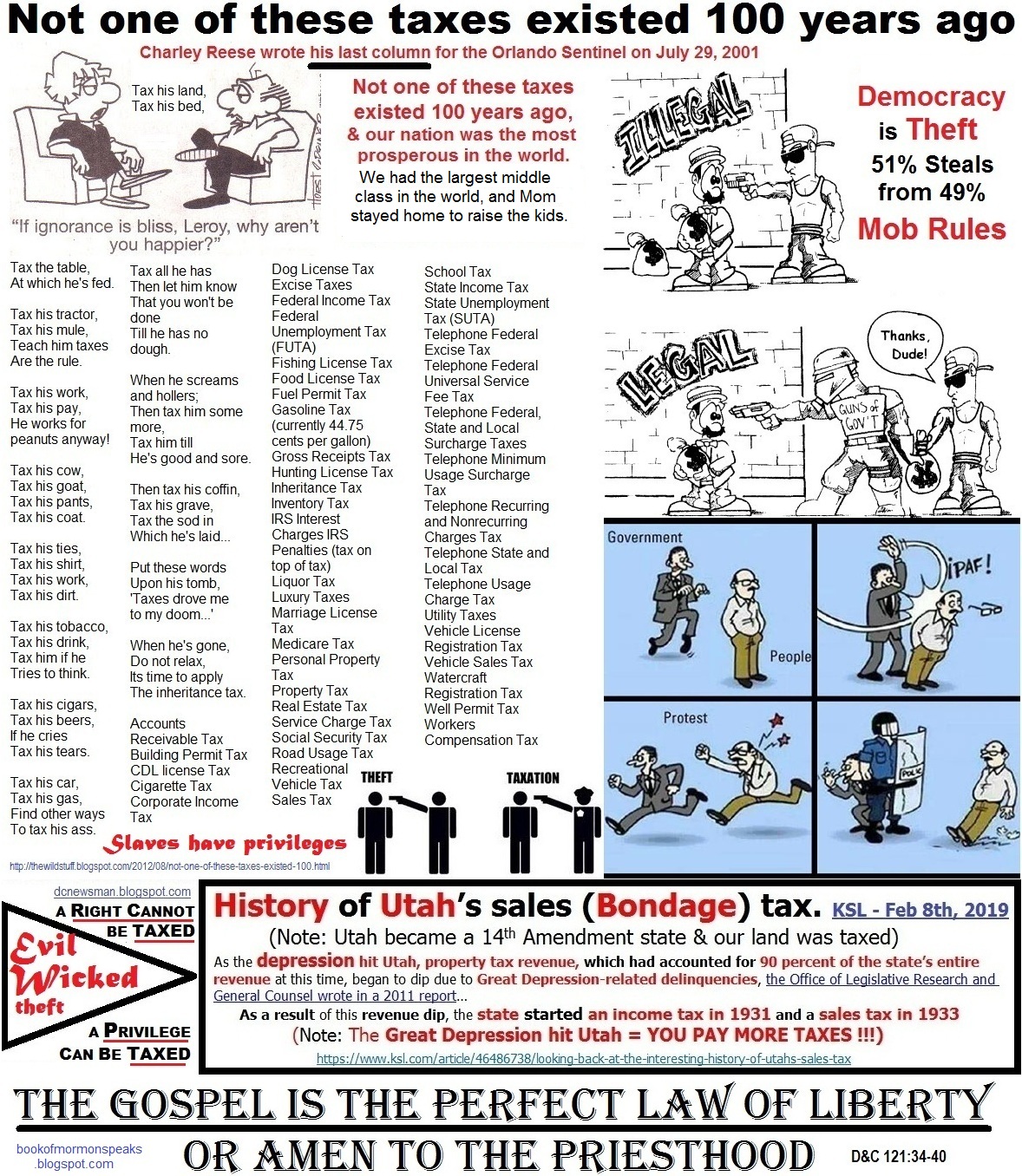

History of Utah’s

sales (Bondage) tax

(Note: Utah became a 14th amendment state our land was taxed)

KSL -- 2-8-2019

KSL -- 2-8-2019

As the depression hit Utah, property tax revenue, which had accounted for 90 percent of the state’s entire revenue at this time, began to dip due to Great Depression-related delinquencies, the Office of Legislative Research and General Counsel wrote in a 2011 report…

As a result of this revenue dip, the state started an income tax in 1931 and a sales tax in 1933 to diversify its revenue situation, the 2011 report pointed out. By the 1970s, sales tax overtook property tax as the state’s largest revenue

(Great Depression hit Utah = YOU PAY MORE TAXES !!!)

https://www.ksl.com/article/46486738/looking-back-at-the-interesting-history-of-utahs-sales-tax

%20citizenship%20-%20John%20Quade%20(2).jpg)

%20Articles%20of%20Faith.jpg)

%20Articles%20of%20Faith.jpg)